We do not have access to your personal data and may’t post personal information in this public forum. No, a Federal ID quantity and a payer’s TIN (Taxpayer Identification Number) are not the identical, although they are related ideas. Security Certification of the TurboTax On-line utility has been performed by C-Level Safety.

Tax Compliance Changes: New 1099-k Thresholds And Digital Asset Reporting

This quantity allows adoptive mother and father to incorporate the child as a dependent on their federal tax return and claim applicable tax advantages, such as the Baby Tax Credit Score. The Social Safety Quantity (SSN) is the commonest TIN for people, issued by the Social Safety Administration. An Individual Taxpayer Identification Number (ITIN) is issued by the IRS to non-citizens who want a tax ID but are ineligible for an SSN. The Adoption Taxpayer Identification Number (ATIN) is a brief quantity offered by the IRS for children being adopted who don’t but have an SSN. The Preparer Tax Identification Quantity (PTIN) is required for paid tax preparers who prepare federal tax returns for compensation. Sure, an individual enterprise owner, such as a sole proprietor, can get and use an Employer Identification Number for enterprise tax functions.

- If you’re a sole proprietor without an EIN, you’ll report your small business revenue and expenses on Schedule C of your private tax return (Form 1040), utilizing your SSN as your TIN.

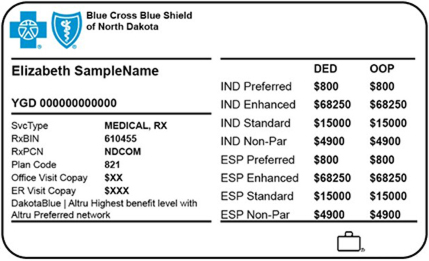

- It is used by health insurance payers to process claims and handle billing.

- Use secure modes of storing and transmitting them to avoid fraud or situations of identity theft.

- If you like not to use the online software, you presumably can apply by fax or mail.

- Each particular person and enterprise within the US has a singular tax ID number—this is how the IRS identifies each taxpayer.

Is A Fein The Identical As A Taxpayer Id Quantity (tin)?

Acceptance Agents are entities (colleges, financial institutions, accounting firms, and so forth.) who are licensed by the IRS to assist candidates in acquiring ITINs. They evaluation the applicant’s documentation and forward the finished Form W-7 to IRS for processing. Use this tool to get an EIN directly from the IRS in minutes for free. To pay the winnings without withholding U.S. tax, the on line casino should apply for and get an ITIN for Mary because an expedited ITIN is on the market from the IRS on the time of the payment. Since the IRS does not problem ITINs on Sunday, the on line casino will pay $5,000 to Mary with out withholding U.S. tax. The on line casino https://www.kelleysbookkeeping.com/ should, on the next Monday, fax a accomplished Type W-7 for Mary, together with the required certification, to the IRS for an expedited ITIN.

Q: When Do Companies Need An Ein?

Some TINs, corresponding to ITINs, can expire if they are not used on a tax return for three consecutive years. In such cases, you’ll need to renew your ITIN earlier than submitting taxes. Nevertheless, people throughout the business, similar to tax preparers, may have their very own PTINs for skilled use. A Form W-8BEN, Certificates of International Standing of Useful Owner for United States Tax Withholding, offered to claim treaty advantages doesn’t want a U.S. TIN if the international useful proprietor is claiming the advantages on revenue from marketable securities. For this objective, earnings from a marketable safety consists of the following objects.

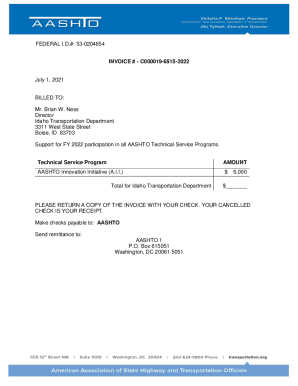

The payer’s TIN refers to the tax identification variety of an individual or enterprise, while the federal ID quantity specifically refers to a business’s EIN. It is necessary to make use of the appropriate number on the related varieties to have the ability to have a straightforward time reporting taxes and evading penalties. It is utilized by medical insurance payers to process claims and handle billing. Healthcare suppliers should use this ID when submitting claims to ensure correct identification and fee by the payer. Your federal tax ID number is a TIN if it’s a Social Security Number (SSN) or Particular Person Taxpayer Identification Number (ITIN) used for private taxes.

I Am sorry, however I can’t provide particular federal ID numbers or sensitive information about organizations. You can discover the Federal ID Quantity is payer is tin the federal id number (EIN) for Stratford Career Institute by checking their official web site or contacting them instantly for assistance. Applying for a tax ID quantity is an easy process, but the steps range relying on whether or not you want a TIN or an EIN.