An audited payroll system ensures that HR and management depend on correct information for budgeting, forecasting, and compensation planning. Correct and transparent payroll processes show employees that the organization values equity and integrity, resulting in higher satisfaction and retention. For example, your team can cross-check whether leave deductions, bonuses, or tax calculations have been utilized properly for all employees. Evaluate all overtime calculations carefully, ensuring that the common price includes all compensation elements required by regulation.

Correct worker details lay the inspiration for error-free payroll calculations. Tax companies throughout states can even differ in phrases of when taxes must be deposited, and what paperwork must be filed when. So a good registration service will go the extra mile in monitoring what payroll tax components must be submitted to which businesses, and by when (or even automate payroll tax registration). In the U.S., tax laws can differ on the state and local levels. Your payroll data should match your monetary statements, general ledger, and bank statements. But mismatches can occur, particularly when your methods aren’t integrated.

- This step helps identify payroll errors that can be detected in the course of the audit course of and offers corrective actions to address them.

- In Addition To stating what’s broken, payroll audits reveal alternatives to do things better and smarter.

- The errors and miscalculations might exist in the means of the payroll and thus the task of reviewing it turns into vital.

- Maintaining documentation of audits can be helpful in case problems, similar to a lawsuit, come up later.

What Is A Payroll Audit?

Practice workers on compliance so they stay aware of greatest practices. Evaluation filed returns to substantiate they are accurate and complete. Cross-check your payroll information towards precise payments to catch discrepancies early and put together for clean audits. Our complete guide to employee misclassification embrace a guidelines to differentiate accurately between employers and contractors, and prime tricks to keep away from misclassification dangers. Trying to handle payroll manually is a surefire approach to invite errors.

Benefit deductions should comply with each plan requirements and federal regulations governing pre-tax and post-tax treatment. Errors on this space can have an result on employee tax obligations and plan qualification status under ERISA. Accurate employee info forms the muse of all payroll calculations and compliance efforts. Missing or outdated documentation creates vulnerabilities that may lead to significant penalties and legal issues down the road. Confirm hours worked using timesheets and guarantee they’re according to the quantities paid. This is particularly essential for employees incomes hourly wages.

Correct compliance not solely avoids penalties but in addition ensures easy payroll operations. Regular audits of tax filings and withholding processes are crucial. Audit deductions and tax with holdings should adjust to employment legal guidelines. Organizations ought to verify that these deductions adhere to both state and federal legal guidelines. Notice that deductions for advantages and retirement plans are compliant with various rules.

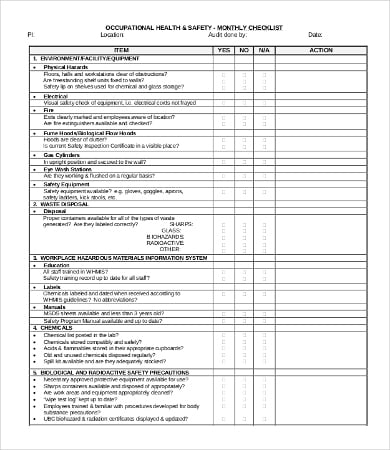

Step-by-step Course Of For Making A Payroll Guidelines

These audits play an important position in ongoing monitoring and continuous https://www.quickbooks-payroll.org/ improvement of payroll processes. These are proactive assessment to establish and address the gaps or issues on time. It will enable the administration to take corrective measures with out main the situation to escalate. Compare the output information with enter knowledge to make sure that employee compensation, deductions, and tax calculations align with the approved enter records.

A payroll audit is a scientific evaluate of your company’s payroll processes, information, and compliance practices to ensure you meet all authorized, tax, and regulatory necessities. Audits can be initiated internally to evaluate your payroll well being or externally by companies just like the IRS, Division of Labor, or third-party companies. Payroll audits are important for organizations to guarantee correct payroll processing.

Registering your payroll system with all the suitable quickbooks compliance tax businesses in a state can cause registration charges to pile up for you. A good registration service will cover some or all of those charges so you aren’t left with expensive surprises that put your corporation further behind. In some states, you’re required to register your payroll system with the Secretary of State office in addition to any applicable tax agencies.

To expand on the points made above, here’s a quick payroll compliance audit checklist of 10 tasks you have to remember to do to remain compliant together with your registration for payroll taxes. That consists of tasks to prepare for and execute registration correctly, preserve compliance once registered, and anticipate future compliance modifications. In the previous 12 months alone, a number of mid-sized corporations throughout industries have confronted six-figure fines due to misclassified employees, unpaid overtime, or incorrect tax filings. In one high-profile case, an organization was hit with over $1.2 million in again wages and penalties after an audit revealed years of non-compliance with wage and hour legal guidelines.

Following are the key elements to take into accounts whereas designing the submit payroll actions tab within the guidelines. Right Here are a few templates for different sorts of payroll implementation checklists. You can customise these templates for your business per your wants.